欢迎访问云皓的自动化美股交易之家! Welcome to Yunhao's home of automated stock trading!

Chinese Version中文版!

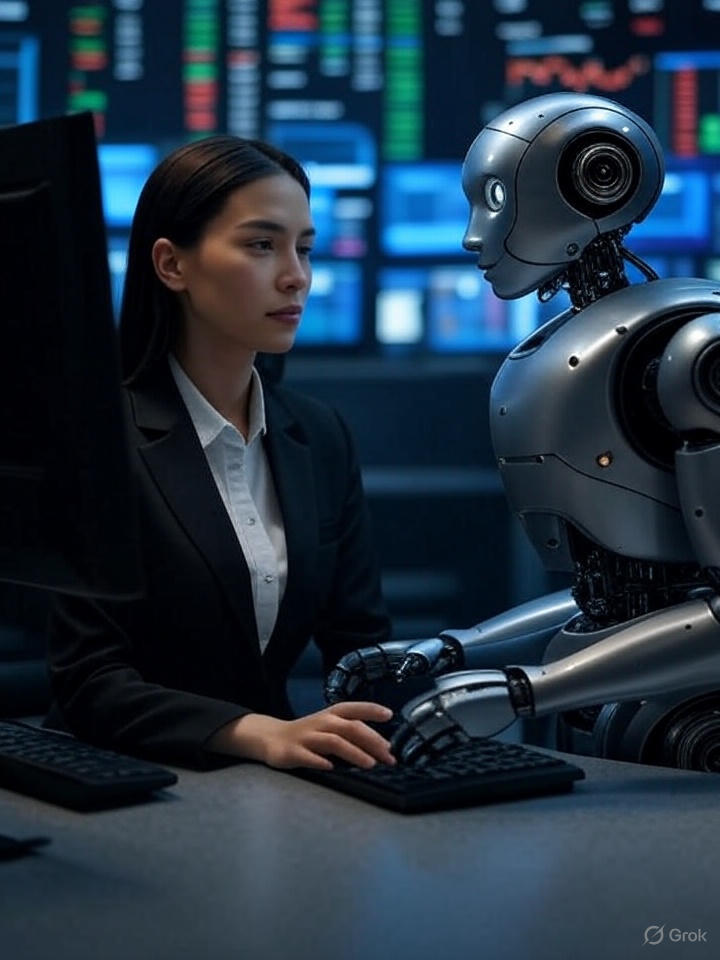

Congratulation! The hottest AI stock broker is in town for you!

Traditional Stock Trading

- Primarily focused on long-term holding, making it difficult to accurately time buying and selling within a day

- Long-term positions bring significant mental stress and anxiety

- Losses leading to feelings of disappointment and frustration, tormented by greed and fear

- Financial losses due to untimely stop-loss, leverage risks, and accumulating debt

- Time-consuming and mentally draining, impacts life and family, disrupting life balance

- Long-term positions bring significant mental stress and anxiety

- Losses leading to feelings of disappointment and frustration, tormented by greed and fear

- Financial losses due to untimely stop-loss, leverage risks, and accumulating debt

- Time-consuming and mentally draining, impacts life and family, disrupting life balance

Automated Computer Trading

- Efficiently conducts intraday trading, accurately timing buys and sells

- Effectively manages over 50 stocks or more if needed

- No long-term positions, eliminating stress and anxiety from life

- Computers can accurately and timely execute profit-taking and stop-loss, avoids emotional trading thus increasing win rates

- Computers not only execute timely stop-loss but also avoid increasing leverage and debt

- Highly efficient and time-saving, saving time and effort, bringing harmony and happiness to life

- Effectively manages over 50 stocks or more if needed

- No long-term positions, eliminating stress and anxiety from life

- Computers can accurately and timely execute profit-taking and stop-loss, avoids emotional trading thus increasing win rates

- Computers not only execute timely stop-loss but also avoid increasing leverage and debt

- Highly efficient and time-saving, saving time and effort, bringing harmony and happiness to life

- Batch bots work in parallel. All trades are executed by computer programs, with buy and sell points, including profit-taking and stop-loss, fully pre-set.

- The bot program executes trades with precision, offering unmatched timeliness, accuracy, efficiency, and discipline compared to manual trading.

- Machine trading perfectly overcomes the inefficiencies, delays, and emotional pitfalls of manual trading.

- All trades are conducted within the same day, with all securities cleared before the market closes, avoiding the potential risks of long-term holdings.

- Our philosophy is: money that can be earned in 1-2 hours should not take 3-5 hours; money that can be earned in one day should not take 3-5 days, a week, or even a month.

The main strategy for investors to control risks and improve trading consistency include diversification, implementing stop-loss strategies, controlling trade size, and avoiding emotional trading. The advent of computer trading and AI has made these methods and strategies operationally feasible:

- A powerful intelligent scanning system can combine fundamental news and technical stock chart trends to select stocks with potential for significant intraday fluctuations from thousands of stocks. It chooses 1–50 stocks from different sectors as intraday trading targets and develops hedging strategies to reduce potential risks.

- The trading bots can simultaneously execute buying, selling, and managing 10, 20, or even more than 50 stocks intraday without human intervention. This diversification significantly reduces intraday trading risks.

- Each automated trade is preset with take-profit and stop-loss points, which is crucial in the fast-changing intraday market. Once these points are triggered, the computer executes take-profit and stop-loss orders accurately and instantly.

- The bots eliminate emotional trading, overcoming the biggest enemy of trading—human greed and fear.

- The bots can precisely control trade size: when the market is strongly bullish intraday, most preset buy orders are automatically activated, increasing the trade size; when the market is stable or bearish, most preset buy orders are not triggered, automatically reducing trade size to avoid potential risks.

-Since no long-term stock holding is involved, our return rate calculation is straightforward, as follows:

Daily return rate % = (Account balance after market close - Account balance before market open) / Account balance before market open (assuming all funds are used for intraday trading).

- The trading bots can simultaneously execute buying, selling, and managing 10, 20, or even more than 50 stocks intraday without human intervention. This diversification significantly reduces intraday trading risks.

- Each automated trade is preset with take-profit and stop-loss points, which is crucial in the fast-changing intraday market. Once these points are triggered, the computer executes take-profit and stop-loss orders accurately and instantly.

- The bots eliminate emotional trading, overcoming the biggest enemy of trading—human greed and fear.

- The bots can precisely control trade size: when the market is strongly bullish intraday, most preset buy orders are automatically activated, increasing the trade size; when the market is stable or bearish, most preset buy orders are not triggered, automatically reducing trade size to avoid potential risks.

-Since no long-term stock holding is involved, our return rate calculation is straightforward, as follows:

Daily return rate % = (Account balance after market close - Account balance before market open) / Account balance before market open (assuming all funds are used for intraday trading).

Our stock brokerage service is entirely based on the client's own account, eliminating any risk of illegal access, transfer, or fraud. If you are already with Charles Schwab and using Thinkorswim Platform, skip this part. We can hit the ground running.

- The client personally opens a stock trading account with American brokerage Charles Schwab.

Canadians need an American address to open an account, or if you have multi citizenships, use a non-Canadian passport to open the account.

- The client personally opens an account with an American based bank.

- The client personally manages funds between bank account and brokerage account.

- Once client authorize us to trade under Charles Schwab accouunt, our automated stock trading services can begin.

- The client personally opens an account with an American based bank.

- The client personally manages funds between bank account and brokerage account.

- Once client authorize us to trade under Charles Schwab accouunt, our automated stock trading services can begin.

We charge a certain percentage of the profits as a service commission, with the specific commission rate depending on the amount of funds in your stock account, ranging, for example, from 15% to 30%. Clients with Larger-scale fund can have relatively discounted commission rates.

We emphasize that we only have permission to execute buy and sell operations in the stock account. We have zero permission to deposit, withdraw, or transfer funds. We ensure 100% safety of the client’s funds.

Latest Day Trading Exmaple

More demos,please visit our Youtube channel:

Contact us:

China: 8613759546604

Canada tech support: 1-416-559-6900

Wechat:1420201

Email: yunyang01@gmail.com 554910195@qq.com